EMI Calculator

Your Amortization Details (Yearly/Monthly)

Table of Contents

What is an EMI calculator?

An EMI calculator is a simple online tool that helps you figure out how much you’ll need to pay every month if you take a loan

What is an EMI?

An EMI, or Equated Monthly Installment, is a fixed amount of money you pay every month to repay a loan. When you take a loan from a bank or a financial institution, you agree to pay back the borrowed amount along with interest over a specified period. The EMI is the monthly amount that combines both the principal loan amount and the interest, ensuring that the loan is paid off in equal installments over the loan tenure. Use this EMI calculator to calculate your monthly EMI.

How Does EMI Work?

-

- Loan Amount: This is the total money you borrow.

-

- Interest Rate: This is the percentage of the loan amount that the lender charges you for borrowing the money.

-

- Loan Tenure: This is the time period over which you agree to repay the loan.

When you combine these three factors, you get your EMI, which is the amount you need to pay each month. For example, if you borrow ₹1,00,000 at an interest rate of 10% per year for 1 year, your EMI would include part of the ₹1,00,000 and part of the interest.

Why is EMI Important?

-

- Budgeting: Knowing your EMI helps you plan your monthly budget.

-

- Financial Planning: It gives you a clear picture of how much you need to set aside each month.

-

- Loan Management: Understanding your EMI helps you manage your loan better and avoid any defaults.

In simple terms, an EMI is like a monthly payment plan that makes it easier for you to pay back your loan without having to pay a large amount of money all at once.

Note- use this free to use EMI calculator to calculate your monthly EMI

How EMI is calculated?

Calculating EMI (Equated Monthly Installment) might sound complicated, but it’s quite simple once you understand the basics. Here’s a straightforward explanation to help you understand how it works.

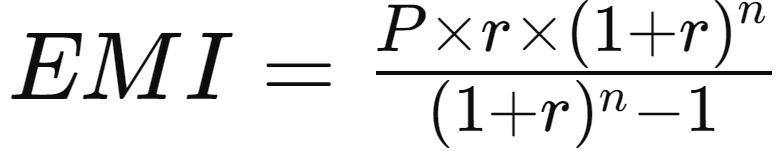

The EMI Formula

The formula to calculate EMI is:

Where:

-

- P = Loan Amount (Principal)

-

- r = Monthly Interest Rate (Annual Interest Rate divided by 12 and then by 100)

-

- n = Loan Tenure (in months)

Breaking Down the Formula

- Loan Amount (P): This is the total amount of money you borrow from the lender.

- Monthly Interest Rate (r): This is the annual interest rate divided by 12 (to get the monthly rate) and then by 100 (to convert the percentage into a decimal).

- Loan Tenure (n): This is the total number of months you will take to repay the loan.

Example Calculation

For example, If a person avails a loan of ₹10,00,000 at an annual interest rate of 7.2% for a tenure of 120 months (10 years), then his EMI will be calculated as under:

EMI= ₹10,00,000 * 0.006 * (1 + 0.006)120 / ((1 + 0.006)120 – 1) = ₹11,714.

Just input all the values in this EMI calculator and you will get your monthly EMI

How to use this online EMI calculator?

Calculating your EMI (Equated Monthly Installment) is simple and quick with our online EMI calculator. Follow these steps to get started:

Step-by-Step Guide:

-

- Loan Amount:

-

- Input the Desired Loan Amount: Enter the total amount of the loan you wish to avail. This is the principal amount you will borrow.

-

- Loan Amount:

-

- Loan Tenure (In Years):

-

- Input the Desired Loan Term: Specify the duration for which you want to take the loan. This tenure is usually in years. Remember, a longer tenure can help in enhancing your eligibility by reducing the EMI amount.

-

- Loan Tenure (In Years):

-

- Interest Rate (% P.A.):

-

- Input the Interest Rate: Enter the annual interest rate offered by the lender. This rate will be used to calculate the interest on your loan.

-

- Interest Rate (% P.A.):

Example:

-

- Loan Amount: ₹500,000

-

- Loan Tenure: 5 Years

-

- Interest Rate: 8.5% P.A.

- By inputting all these values in the EMI calculator you will get a Monthly EMI: ₹10,258.27 (per month)

What Happens Next:

After entering these details, this EMI calculator will compute your monthly EMI amount. It will consider the principal amount, interest rate, and loan tenure to provide you with an accurate EMI figure, helping you plan your finances better.

Benefits of Using Our EMI Calculator:

-

- Accurate Results: Get precise EMI calculations to plan your loan repayments effectively.

-

- Time-Saving: Quickly see your monthly obligations without manual calculations.

-

- User-Friendly: Simple inputs make it easy for anyone to use, even without financial expertise.

Start planning your loan effectively by using our EMI calculator now!

Can I pay missed EMI next month?

Yes, you can pay a missed EMI the next month, but it’s important to understand the implications and process:

-

- Late Payment Penalties: Most lenders charge a late fee or penalty for missed EMIs. This fee will be added to your next month’s EMI.

-

- Interest on Missed EMI: In addition to the penalty, interest will continue to accrue on the unpaid amount, increasing your overall loan cost.

-

- Impact on Credit Score: Missing an EMI payment can negatively impact your credit score, which can affect your ability to get loans in the future.

-

- Communication with Lender: It’s crucial to communicate with your lender if you anticipate missing an EMI payment. They may offer options like a grace period, a temporary reduction in EMI, or restructuring the loan.

Steps to Take if You Miss an EMI:

-

- Contact Your Lender: Inform them about your situation. This shows responsibility and can sometimes result in waived penalties or alternative payment arrangements.

-

- Pay the Missed EMI with Next Month’s Payment: Make sure to pay both the missed EMI and the current month’s EMI to avoid further penalties.

-

- Check Your Loan Agreement: Understand the terms related to missed payments, including penalties and interest.

Avoiding Future Missed EMIs:

-

- Set Up Reminders: Use reminders or automatic payments to ensure you don’t miss an EMI.

-

- Emergency Fund: Maintain an emergency fund to cover EMIs during financial hardships.

-

- Budgeting: Regularly review and adjust your budget to ensure timely EMI payments.

While paying a missed EMI next month is possible, it’s best to avoid missing payments due to the financial and credit score implications. Always communicate with your lender to find the best solution.

Note- use this free to use EMI calculator to plan your Loan expenses

Can I Pay EMI in Advance?

Yes, you can pay your EMI in advance! This is known as prepaying your EMI. When you prepay, you’re paying your Equated Monthly Installment (EMI) before its due date. Here’s how it works and why it might be beneficial:

-

- Reduced Interest Burden: By paying in advance, you reduce the principal amount faster. This means you will pay less interest over the loan’s tenure.

-

- Shorter Loan Tenure: Regular prepayments can help shorten the duration of your loan, allowing you to become debt-free sooner.

-

- No More Monthly Stress: Prepaying can reduce the monthly financial burden, making it easier to manage your budget.

-

- Check for Charges: Some lenders might charge a prepayment penalty, so it’s important to check your loan agreement or ask your lender about any potential fees.

Prepaying your EMI can be a smart financial move, but always consider your overall financial situation before deciding.

Note- use this free to use EMI calculator to plan your Loan expenses

Can I pay extra EMI every month?

Yes, you can pay your EMI in advance! This is known as prepaying your EMI. When you prepay, you’re paying your Equated Monthly Installment (EMI) before its due date. Here’s how it works and why it might be beneficial:

-

- Reduced Interest Burden: By paying in advance, you reduce the principal amount faster. This means you will pay less interest over the loan’s tenure.

-

- Shorter Loan Tenure: Regular prepayments can help shorten the duration of your loan, allowing you to become debt-free sooner.

-

- No More Monthly Stress: Prepaying can reduce the monthly financial burden, making it easier to manage your budget.

-

- Check for Charges: Some lenders might charge a prepayment penalty, so it’s important to check your loan agreement or ask your lender about any potential fees.

Prepaying your EMI can be a smart financial move, but always consider your overall financial situation before deciding.

Note- use this free to use EMI calculator to plan your Loan expenses

Can I Skip My EMI?

Skipping an EMI is generally not advisable, but there are certain circumstances under which it might be possible. Here’s what you need to know:

-

- Lender Policies: Some lenders offer options to defer or skip an EMI under special circumstances, such as financial hardship, medical emergencies, or during a moratorium period.

-

- Moratorium Periods: In situations like natural disasters or economic crises, regulatory bodies may allow lenders to offer moratoriums where you can defer EMIs for a specified period without being penalized.

-

- Impact on Loan Tenure and Interest: Skipping an EMI usually means the missed payment will be added to the end of your loan tenure, and interest will continue to accrue on the outstanding principal. This will increase the overall cost of the loan.

-

- Credit Score Impact: Missing an EMI without prior arrangement or lender approval can negatively impact your credit score, making it harder to secure loans in the future.

What to Do If You Need to Skip an EMI:

-

- Communicate with Your Lender: Contact your lender as soon as possible to explain your situation. They may offer options such as a temporary deferment or restructuring of the loan.

-

- Check Loan Terms: Review your loan agreement for any provisions related to skipping or deferring payments.

-

- Consider Alternative Arrangements: If skipping an EMI is not allowed, explore other options like using savings, borrowing from friends or family, or securing a short-term loan to cover the EMI.

Tips to Avoid Skipping EMIs:

-

- 1. Emergency Fund: Maintain an emergency fund to cover unexpected expenses and ensure timely EMI payments.

-

- 2. Budgeting: Regularly review your budget and cut unnecessary expenses to prioritize EMI payments.

- 3. Automatic Payments: Set up automatic payments to ensure you never miss an EMI due to forgetfulness.

While skipping an EMI can be an option in certain situations, it’s important to understand the consequences and explore all alternatives. Always communicate with your lender to find the best solution for your financial situation.

Note- use this free to use EMI calculator to plan your Loan expenses

Is EMI a Good Option?

Choosing an EMI (Equated Monthly Installment) option can be a good financial decision, but it depends on your specific circumstances and financial goals. Here are some reasons why EMI might be a good option:

- Affordability: EMIs make large expenses more manageable by breaking down the total cost into smaller, regular payments. This allows you to purchase expensive items or services without having to pay the entire amount upfront.

- Budgeting: Fixed monthly payments help you budget more effectively, as you know exactly how much you need to set aside each month for the EMI. You can use this free to use EMI calculator to see your Calculated EMI

- Access to Credit: EMIs provide access to credit for purchasing essentials like a home, car, or education, which might be difficult to pay for in one lump sum.

- Credit Score Improvement: Regular, timely EMI payments can help build and improve your credit score, making it easier to obtain loans and credit in the future.

- Flexibility: Many lenders offer flexible EMI options, including varying loan tenures and interest rates, allowing you to choose a plan that best fits your financial situation.

Considerations Before Opting for EMI:

- Interest Costs: Understand that taking a loan means paying interest, which adds to the overall cost of your purchase. Compare interest rates from different lenders to find the best deal.

- Loan Tenure: Longer loan tenures mean lower EMIs but higher total interest paid over time. Shorter tenures mean higher EMIs but lower overall interest.

- Financial Stability: Ensure you have a stable income to cover your EMI payments consistently. Missing EMIs can lead to penalties and negatively impact your credit score.

- Total Cost: Consider the total cost of the loan, including interest and any other fees, to understand the full financial commitment.

You can use this free to use EMI calculator to see your Calculated EMI

When EMI is a Good Option:

- Purchasing Essential Items: For essential big-ticket items like a house, car, or education.

- Emergency Expenses: When facing large unexpected expenses and you don’t have sufficient savings.

- Building Credit: When you want to build or improve your credit score through regular, timely payments.

When to Avoid EMI:

- High-Interest Rates: If the interest rates are excessively high, it might be better to save up and make the purchase outright. You can use this free to use EMI calculator to see your Calculated EMI

- Unstable Income: If you’re unsure about your ability to make regular payments due to unstable income or financial uncertainty.

- Non-Essential Purchases: For non-essential items that you can save up for instead of taking on debt.

In summary, EMIs can be a good option for managing large expenses and building credit, provided you carefully consider the interest costs, loan tenure, and your ability to make consistent payments. Always assess your financial situation and compare different loan offers to make an informed decision.

You can use this free to use EMI calculator to plan your loan effectively

FAQ

For what types of loans can I utilize the EMI calculator?

Use this free EMI calculator for all types of loans

What happens if I don’t pay my EMIs on time?

You can use this free to use EMI calculator to plan your loan effectively

what is Tax Benefit on Personal Loan

for more info go to Tax benefits on Personal Loan

what is no cost EMI?

Note – this EMI calculator does not calculates your no cost EMI

What is the difference between no cost EMI and normal EMI?

No Cost EMI:

- Interest-Free: No additional interest charges.

- Fixed Monthly Payments: Total product cost is divided into equal installments.

- Subsidies/Discounts: Retailers or manufacturers may cover the interest cost.

- Processing Fees: May apply, so check terms.

Normal EMI:

- Interest Charges: Additional interest is added to the product cost.

- Total Cost Higher: Due to the interest paid over the loan term.

- Wide Availability: Available for more products and lenders.

- Flexible Tenures: Various repayment periods available.

- Key Difference: No Cost EMI involves no interest, making the total payment equal to the product price, while Normal EMI includes interest, increasing the overall cost.

Note – this EMI calculator to calculates your Normal monthly EMI

Our Recent blog post: https://befinancialliterate.com/mutual-fund-profitable/

Disclaimer

This blog is for educational purposes only. The information provided here is intended to offer general guidance and is not a substitute for professional advice. While we strive to ensure the accuracy and completeness of the content, we make no guarantees about its reliability, accuracy, or suitability for any specific purpose. Always seek the advice of qualified professionals before making any financial, legal, or other significant decisions based on the information provided in this blog.

Very useful calculator for finding out monthly emi’s